- ACCOUNTS PROJECT FOR CLASS 11TH CBSE PDF

- ACCOUNTS PROJECT FOR CLASS 11TH CBSE FULL

- ACCOUNTS PROJECT FOR CLASS 11TH CBSE TRIAL

ACCOUNTS PROJECT FOR CLASS 11TH CBSE TRIAL

(i) Errors which do not affect trial balance L Errors: classification-errors of omission, commission, principles, and compensating their effect on Trial Balance. (Scope: Trial balance with balance method only) L Trial balance: objectives, meaning and preparation Trial balance and Rectification of Errors L Difference between capital and revenue reserve L Provisions, Reserves, Difference Between Provisions and Reserves. Creating provision for depreciation/accumulated depreciation account L Other similar terms: Depletion and Amortisation L Depreciation: Meaning, Features, Need, Causes, factors

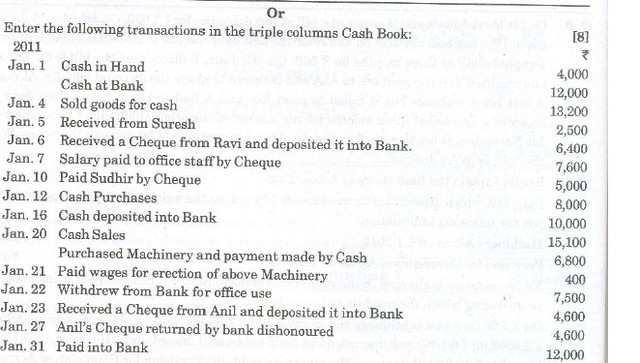

L Need and preparation, Bank Reconciliation Statement L Ledger: Format, Posting from journal and subsidiary books, Balancing of accounts Note: Including trade discount, freight and cartage expenses for simple GST calculation. L Cash Book: Simple, cash book with bank column and petty cashbook L Recording of Transactions: Books of Original Entry- Journal L Voucher and Transactions: Source documents and Vouchers, Preparation of Vouchers, Accounting Equation Approach: Meaning and Analysis, Rules of Debit and Credit.

L Explain the meaning, advantages and characteristic of GST. L explain the bases of recording accounting transaction and to appreciate that accrual basis is a better basis for depicting the correct financial position of an enterprise. L acknowledge the fact that recording of accounting transactions follows double entry system. L appreciate that various accounting standards developed nationally and globally are in practice for bringing parity in the accounting treatment of different items. L explain the meaning, applicability, objectives, advantages and limitations of accounting standards. L describe the meaning of accounting assumptions and the situation in which an assumption is applied during the accounting process.

L give examples of terms like business transaction, liabilities, assets, expenditure and purchases. L explain the various terms used in accounting and differentiate between different related terms like current and non-current, capital and revenue. L identify / recognise the individual(s) and entities that use accounting information for serving their needs of decision making. L describe the meaning, significance, objectives, advantages and limitations of accounting in the modem economic environment with varied types of business and non-business economic entities. L Goods and Services Tax (GST): Characteristics and Advantages.Īfter going through this Unit, the students will be able to: L Accounting Standards: Applicability in IndAS Basis of Accounting: cash basis and accrual basis

ACCOUNTS PROJECT FOR CLASS 11TH CBSE FULL

L Basic accounting concept : Business Entity, Money Measurement, Going Concern, Accounting Period, Cost Concept, Dual Aspect, Revenue Recognition, Matching, Full Disclosure, Consistency, Conservatism, Materiality and Objectivity L Fundamental accounting assumptions: GAAP: Concept Assets (Non Current, Current) Expenditure (Capital and Revenue), Expense, Revenue, Income, Profit, Gain, Loss, Purchase, Sales, Goods, Stock, Debtor, Creditor, Voucher, Discount (Trade discount and Cash Discount) L Basic Accounting Terms- Entity, Business Transaction, Capital, Drawings. Qualitative Characteristics of Accounting Information. L Accounting- concept, meaning, as a source of information, objectives, advantages and limitations, types of accounting information users of accounting information and their needs. Unit-3: Financial Statements of Sole ProprietorshipĪlso Check CBSE Class 11 Syllabus of All Subjects for 2022-2023 Session (PDF) Therefore, students must know their Accountancy syllabus thoroughly to prepare an effective study plan and score well in their exams.Ĭheck CBSE Class 1 1 Accountancy (Code No.055) Course Structure 2022-23 below: The question paper design for the CBSE Class 11 Accountancy Annual Exam 2022-23 is also mentioned in this syllabus. Students will also get to know the details of the project work for CBSE Class 11th Accountancy subject. This syllabus is helpful to know the course structure and course content suggested by the board for the current academic session.

ACCOUNTS PROJECT FOR CLASS 11TH CBSE PDF

Students can check and download the revised and reduced syllabus in PDF from the link provided here. CBSE Class 11 Accountancy Syllabus 2022-2023 is provided in this article.

0 kommentar(er)

0 kommentar(er)